How To Cancel a Venmo Payment

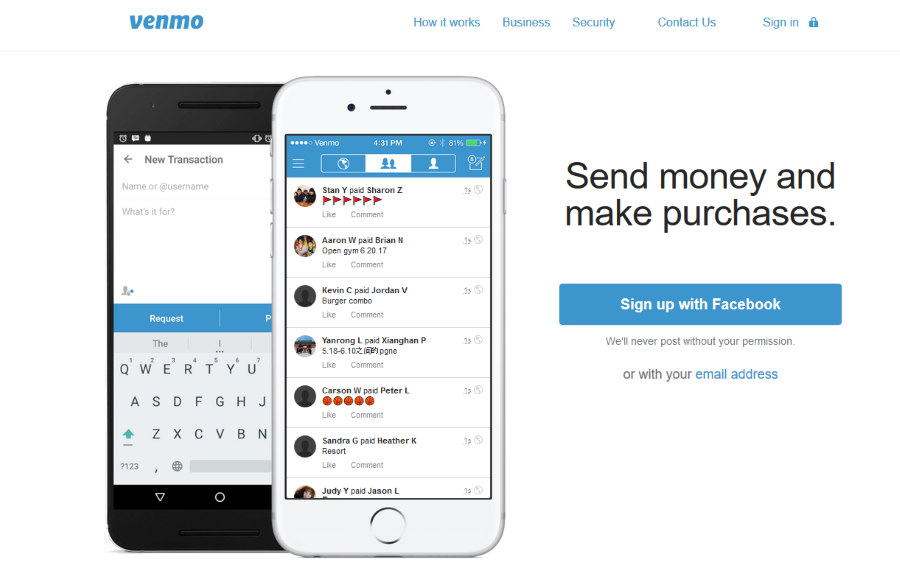

Venmo is a social payments system owned and run by PayPal and using a similar electronic payment model. With Venmo you can split bills with friends, or transfer sums of money from one to another, without any charges (as long as you use a debit card or bank account; using a credit card incurs a 3% charge). So, for example, if you’re out with friends and someone forgets their wallet, that person can repay their friends for a temporary loan using Venmo. It’s very simple to use – set up a Venmo account, add a credit or debit card and you’re set. It really is that simple.

For example, a friend of mine paid for a group dinner on her credit card and then billed us all for our share through Venmo. We could all pay her from our bank account and everything was kept clean and tidy. She didn’t mind paying and we could all pay our way even though not all of us had available funds at the time. It is just one of the many ways Venmo can work. Unfortunately, with it being so easy to make payments on Venmo, it is also easy to pay the wrong person or pay the wrong amount. I know people that have done it and more that will do it again. With that in mind, here is how to cancel a Venmo payment.

Cancel a Venmo payment

Venmo, like PayPal, is a direct payment system and credits accounts immediately. That means any payment you send will appear in the recipients account within seconds and disappear from your balance equally fast. Therefore, under most circumstances you cannot cancel a Venmo payment without intervention from Venmo themselves. If you send money to the wrong person, Venmo suggests sending them a charge for the same amount with a note telling them what happened. If the person sees the note, they can pay you back and all is well. If you don’t hear back and haven’t had your money, you are directed to contact Venmo directly for assistance. They will ask for the username of the person you send the money to, the amount, data of the payment and the username or phone number of the person you meant to pay. Venmo will then try to sort it out. However, there is basically no way for Venmo to force the person to return the money, so if they aren’t honest, you are out of luck.

If you pay a new user, that is, someone who hasn’t yet set up their Venmo account, you will be able to cancel the payment yourself. Open the Venmo app, select the menu icon, select Incomplete and Payments. Select the incorrect payment and then Cancel, and the money will return to your bank account or credit card.

Is Venmo safe?

As an online payment processor, Venmo is obviously susceptible to the same kinds of risks that PayPal is. There is always a risk of hacking, scamming and generally nefarious behavior. While Venmo has had issues with security in the past, the platform apparently uses bank-grade security to protect its data and its network. According to security experts, the majority of thefts or scams from Venmo accounts are as a result of user error. Whether this is true or not is up for debate as there is little evidence either way. However, the user’s responsibility in all of this cannot be ignored.

If you do use Venmo or any online payment service, taking some common sense steps could increase your personal security and reduce the risk of financial loss significantly.

Use a prepaid credit card

The best piece of advice I can give about using online payment systems of any kind is to only use a prepaid card. Load the card with a set amount of money, enough to cover what you need. Then you can use all the benefits of Venmo without the risk of losing any more money than what is on the card. If your account gets hacked, the maximum you will lose will be the amount you loaded onto the card. If someone gets hold of your card details, they won’t be able to get credit or get you into debt.

Don’t leave too much lying around

Leaving a balance on your Venmo account is a convenient way to always have money when you need it. It is also more money to lose if your account is hacked. Leave a little there, enough to cover occasional expenses but not too much where losing it would affect your life. Combined with a prepaid card, a low balance protects you from too much loss.

Secure your account

Finally, the usual rules apply for Venmo as they do for any other account. Make sure your password is suitably secure and that you keep it safe at all times. Combined with the mobile PIN, this is one of the two pieces of information required to hack your account from the outside. Make your password a good one and make sure to never repeat or share it.

Got any other security tips for Venmo you would like to share? Any stories of being hacked or losing money? Share them with us below!