How to Tell if Your Venmo Account is Frozen

If you rely on Venmo to take care of your payments and other financial transactions, having your account frozen can be more than just an inconvenience.

But is there a way to tell if your Venmo account is frozen? In this article, we’ll explain everything you need to know about account freezing with Venmo, and what you can do to remedy the situation.

The Obvious Signs

If your account has been frozen, you’ll get a notice via email informing you about it and the possible reason why.

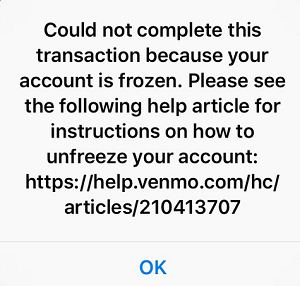

Should you not get the email, or miss it in your inbox, the other obvious sign will be the pop-up message you’ll get the next time you try to make a payment.

The third way you’ll be able to tell if your Venmo account is frozen will be that no payments to you will go through. The person that tries to make a transaction to you will be notified that the payment could not be completed. Hopefully, in that case, they’ll contact you and you’ll find out that way.

Now that we’ve explained how you can tell if your account has been frozen, let’s take a look at the reasons why that might happen, as well as some steps you can take to unfreeze the account.

Why as Your Account Frozen?

The usual reasons Venmo resorts to freezing accounts can be found in their user agreement. Two major issues stand out:

- A failed bank payment or a chargeback.

There are several reasons why a transaction from your bank account could fail. They include insufficient funds in your account and reaching the limit for the number of Automated Clearing House (ACH) transfers. While Venmo can’t view the details of the transaction in question, your bank will most likely be able to tell you exactly what went wrong.

As for chargebacks, they occur when dealing with payments from a credit or debit card. When a chargeback is claimed against your payment, your account will be temporarily frozen until the funds have been secured on it. - Using your personal account to sell goods or services. Venmo has a very strict policy about who can use their platform to charge others in this way. The only ones allowed to use Venmo for business purposes are authorized merchants and owners of Business accounts.

Since Venmo can monitor and investigate your bank transactions, unusual behavior such as frequent payments of similar amounts made to your account, could raise suspicion and result in your account being frozen until the issue is resolved.

Note that there might be another reason for freezing your account. The Restricted Activities section in Venmo’s User Agreement document covers all circumstances under which the company will take action and either temporarily freeze or even close down a user account.

What Can Be Done?

If your account has been frozen, the best way to react would be to contact Venmo directly since there’s no way to unfreeze your account on your own.

In the case of a temporary freeze, usually when a user ends up owing Venmo, the account will be reinstated and working as soon as the money is paid back. This can be done by direct bank payment, but that kind of a transaction will take three to five business days to complete. Because of that, the fastest way of settling the debt is to make the payment by a debit card.

If there’s a more serious issue, all actions will depend on the correspondence with Venmo’s support.

An important thing to note is that, in many cases, account freezing can happen due to a trivial oversight on the user’s part. Some of Venmo’s customers had their accounts frozen for making payments that exceeded the available funds on their bank account, or for attempting to send an amount greater than the weekly spending limit.

The best way to deal with account freezing is not to let it happen because of something you’ve missed or forgot. For that reason, make sure you are aware of your current balance both on your Venmo and bank accounts. Also, don’t forget that the weekly limit on transactions through Venmo is $299.99 for unverified and $4,999 for verified users.

Don’t Let It Go

Finding out your Venmo account has been frozen will surely bring down your mood, but then again, it’s better to know when such things happen than to be unawares. In any case, don’t let such an inconvenience ruin your week! Now that we’ve shown you how to tell if your Venmo account is frozen and what to do about it, you know there are ways to fix the problem.

Did your Venmo account get frozen? How did you get it working normally again? Tell us in the comments section below!

One thought on “How to Tell if Your Venmo Account is Frozen”